Introduction

“If you cannot measure it, you can’t improve it.” — Peter Drucker

First Established in 805 CE in Baghdad, the hospital has evolved significantly since then, becoming an indispensable institution for nations worldwide. Today, we explore the intricacies of the financial systems powering these healthcare giants. These financial systems are the linchpin of their operations, driving their commercial intelligence and enabling the delivery of high-quality care. From budgeting to resource allocation, a hospital’s financial health is paramount. Join us on this journey to explore the financial pulse that sustains hospitals.

The hospital is a highly complex institution related to the safety and wellness of citizens. So, in dealing with the security and regulation of a hospital, every country has its own system and mechanism. Most monitoring is performed by a regulatory board. For example, in India it is the National Accreditation Board for Hospitals and Healthcare Providers (NABH). For the world, it is JCI (Joint Cooperation International), the global organization that certifies healthcare providers worldwide.

Hospital finance is about managing financial resources for medical operations and is central to healthcare funding. These funds cover medicines, general practitioner care, dental care, hospital medical care, and other forms of medical aid. Nations spend a massive chunk of their GDP (Gross domestic product) on healthcare, which is expected to rise by 2025, a sum more significant than the estimated cost of housing and food. What happens to all this money?

Hospital charges comprise the fees and costs associated with the medical services, treatments, procedures, and accommodations provided by a healthcare facility to patients. These charges encompass a wide range of services, including doctor consultations, diagnostic tests, surgeries, medications, hospital stays, and other medical interventions.

The healthcare industry operates under complex billing and pricing systems, influenced by factors such as the type of medical services rendered, the level of care required, the duration of hospitalization, and the resources utilized. Understanding hospital charges is crucial for patients, healthcare providers, and insurance companies, as it directly impacts the financial aspect of healthcare delivery.

Patients must understand hospital charges to make informed decisions about their healthcare and financial planning. Additionally, hospitals and healthcare providers must ensure transparency in their billing processes to maintain trust and provide clarity to patients about the costs associated with their medical care.

Tools to measure Hospital Revenue | Key Performance Indicators:

- Revenue Growth Rate: Measure the percentage increase in hospital charges revenue over a specific period. This KPI indicates the overall financial health and growth of the hospital’s revenue stream.

- Average Revenue per Patient (ARPP): Calculate the average revenue generated from each patient. This KPI helps assess the effectiveness of pricing strategies and identifies opportunities for increasing revenue per patient.

- Collection Efficiency: Monitor the percentage of total charges that are successfully collected from patients and insurance providers. A higher collection efficiency indicates a robust billing and revenue collection process.

- Payer Mix: Analyze the distribution of payments from different payers (e.g., private insurance, government programs, self-pay) to understand the hospital’s dependence on various payment sources.

- Cost-to-Charge Ratio: Evaluate the relationship between hospital costs and charges. A well-managed hospital should aim for an appropriate cost-to-charge ratio to maintain profitability without overpricing services.

- Uncompensated Care Rate: Measure the percentage of services provided without payment, including charity care and bad debt. A lower uncompensated care rate is generally more favorable for the hospital’s financial stability.

- Price Sensitivity Analysis: Conduct periodic price sensitivity analysis to determine how changes in charges impact patient volume and overall revenue. This analysis can help optimize pricing strategies.

- Patient Satisfaction Scores: Assess patient satisfaction with hospital charges and billing processes through surveys or feedback mechanisms. Satisfied patients are more likely to pay their bills promptly.

- Rate of Denied Claims: Track the percentage of insurance claims that are denied by payers. Reducing the rate of denied claims can improve revenue collection and minimize administrative costs.

- Cash Flow Cycle Time: Measure the average time it takes for charges to be converted into cash. A shorter cash flow cycle time indicates efficient revenue collection processes.

The following rationale has been considered when arriving at the appropriate method:

Transparent Pricing: Implement a transparent pricing model that provides patients with clear, itemized bills upfront. Transparent pricing can build trust with patients and reduce disputes over charges.

Personalized Payment Plans: Offer personalized payment plans based on patients’ financial capabilities. This approach can improve patient satisfaction and increase the likelihood of timely payments.

Subscription-based Healthcare: Introduce subscription-based healthcare models, where patients pay a fixed monthly fee for a comprehensive set of services. This can improve patient retention and encourage preventive care.

Value-based Pricing: Consider implementing value-based pricing, where the charges are linked to the outcomes achieved or the value delivered to the patient. This approach aligns hospital revenue with patient health outcomes.

Cost Comparison Tools: Empowering patients with cost information can drive competition and price transparency.

Measuring a hospital’s financial health involves analysing various key performance indicators (KPIs) that provide insights into its revenue, expenses, profitability, and overall financial stability. Here are some essential KPIs for evaluating a hospital’s financial performance:

Operating Margin: This KPI measures the percentage of revenue left after deducting operating expenses. A positive operating margin indicates that the hospital is generating enough revenue to cover its day-to-day operational costs.

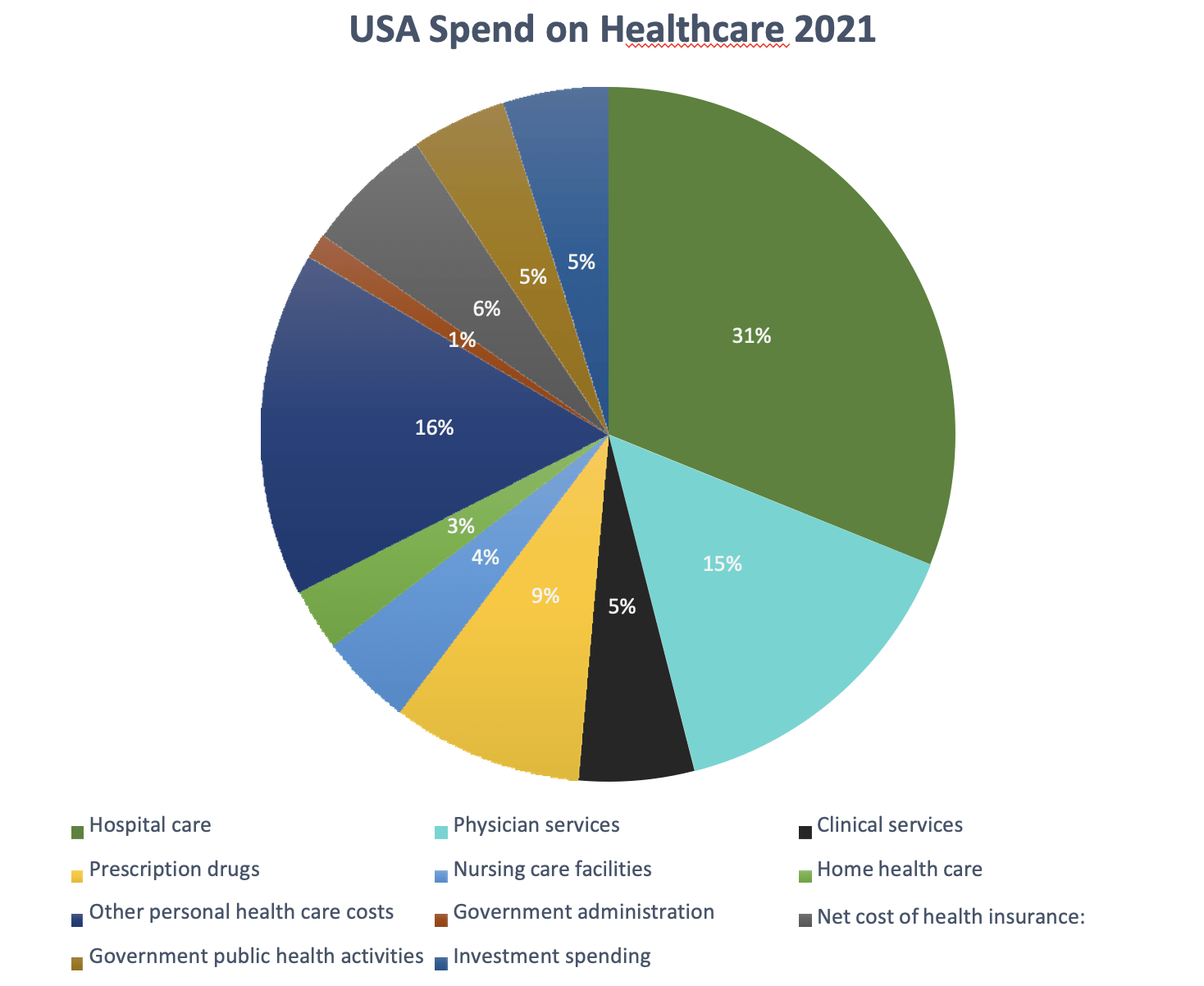

According to data from 2021, Americans spend money on healthcare in the following ways:

Source: American Medical Association website, 2022

After looking at aggregate spending on healthcare, we will now shift focus to the individual finances of a hospital. The finances of the hospital can be summarized into the four Cs:

(1) cost minimization and measurement.

(2) cash management.

(3) capital collection; and

(4) management of resources.

However, there is another way of considering hospital finance:

(1) accounting and

(2) corporate finance.

So, what is the difference between the two? Accounting is the financial measurement of a company’s activities and financial health. And corporate finance involves the application of theory and concepts developed to help managers make better decisions. In practical terms, both functions merge, where accounting helps with the data generation required for decision-making and corporate finance helps provide a framework for those decisions.

Now, if you dig deeper into corporate finance, it uses specific ratios to measure the operational efficiency of the hospital, which are known as key performance indicators. More than 150 ratios are used to check the financial health of a diseased hospital. But here we are going to look at the few most used ratios, which are:

1). Current Ratio (This ratio gauges the hospital’s capacity to cover its immediate obligations.)

2). Average Days in Accounts Receivable This ratio calculates the typical length of the collection period. 3). A more significant number of days corresponds to funds that cannot be used for operations.)

4). Profitability ratio (which measures the profit-generating capacity of the organization)

5). Days in accounts payable (the amount of time it takes an organization to pay its expenses.)

6). Working capital (capital evaluates the business’s capacity to make payments on-time to its creditors)

These are the significant ratios used to measure the disparity in financial discrepancies over the last 100 years.

However, with time, the operation of hospitals started getting more sophisticated, but measuring the financials only made a few upgrades. Furthermore, hospitals’ approach to measuring KPIs is currently at the aggregate level like other industries. And that does not help much to solve the problem or find the exact disease in the financial system.

So, what is the solution? Does even a solution exist?

The solution lies in approaching the problem. Or a change in point of view to look at the problem. So, we need to magnify our horizons to find a better approach. Now, we will look at some of the KPIs that have been recently proposed and focus on the singularity approaches, which are:

- Profit per discharge

This ratio is calculated by deducting the entire inpatient revenue from the total operating expenses. (It is calculated by dividing the net sum by the total number of discharges during the period.) - Net price per discharge – calculate the profit generated from each inpatient discharge. (The net revenue from each patient is divided by the overall number of discharges for the year to arrive at this ratio.)

- Occupancy rate – average number of days when hospital beds were occupied as a percentage of the available 365 days

- Length of stay (ALOS is expressed in days). It is typically calculated by dividing the sum of all inpatient days over a year by the number of admissions or discharges.

(There are the few hospital-specific parameters that can be used in place of existing KPIs, which will help them improve hospital commercial management.)

To conclude, we point out the alternatives to the existing ratios, which must be improved for sound decision-making. And the work of finance should guide enterprises into the future rather than report on what happened previously. Also, we have many studies that suggest strong financial performance is associated with an improved patient-reported experience of care, the most vital component distinguishing quality and safety. So, it is high time we moved on from the old financial measurement metric to a new, updated world of measurement.

References

- 1). Akinleye DD, McNutt LA, Lazario V, McLaughlin CC. Correlation between hospital finances and quality and safety of patient care. Abe T, ed. PLOS ONE. 2019;14(8): e0219124. Doi: HTTPs://doi.org/10.1371/journal.pone.0219124

- INTRODUCTION to HEALTHCARE FINANCE. https://account.ache.org/iweb/upload/ReiterSong_Ch1-4e0b591e.pdf

- WHO European health information at your fingertips.

Gateway.euro.who.int. (https://gateway.euro.who.int/en/indicators/hfa_542-6210-bed-occupancy-rate-acute-care-hospitals-only/) - David Norris, MD. Five financial ratios that track your practice’s financial health. www.medicaleconomics.com. 2021;98(4). (https://www.medicaleconomics.com/view/five-financial-ratios-that-track-your-practice-s-financial-health)

- Carey K, Stefos T. Measuring inpatient and outpatient costs: A cost-function approach. Health Care Financing Review. 1992;14(2):115-124. (https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4193307/)

- OECD. Health care use – Length of hospital stay – OECD Data. The OECD. Published 2017.

(https://data.oecd.org/healthcare/length-of-hospital-stay.htm)